What is a REIT? Understanding Real Estate Investment Trusts

A Comprehensive Guide for Real Estate Students

-

Course Certified & Accredited by NYS DOS & ARELLO®

-

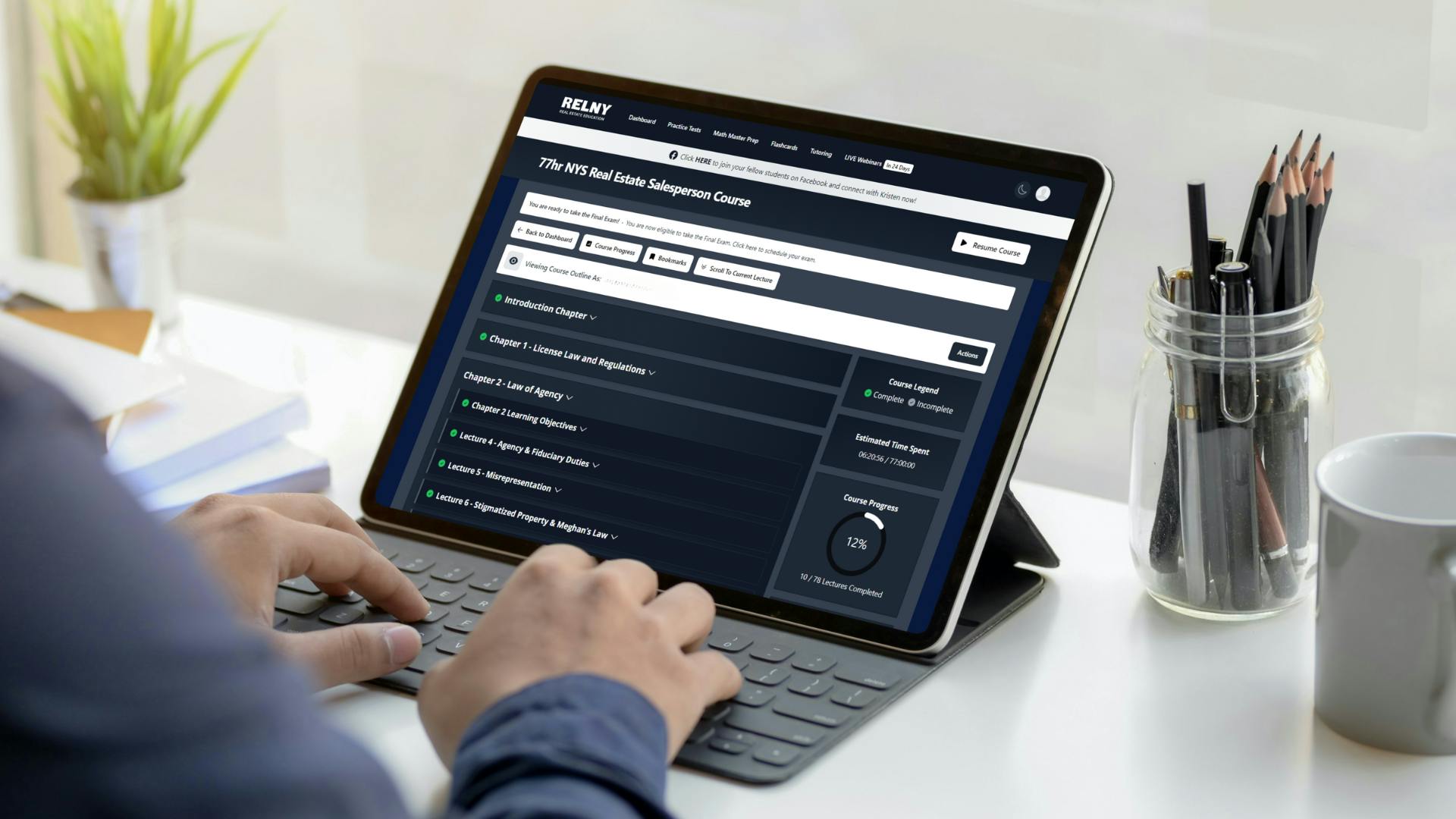

77 Hour NYS Real Estate Salesperson Licensing Course

-

Live Office Hours with Kristen

-

Take Final Exam at Home

-

Kristen's 1:1 Private Tutoring

-

Subtitles/Transcripts for all languages offered by NYS DOS

-

Call/Text (877) 997-3569

Understanding Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) play a pivotal role in the real estate market, offering both novice and seasoned investors an accessible avenue to invest in income-producing properties. For real estate students, understanding REITs is essential for grasping the broader landscape of real estate investment and management. This article delves into what REITs are, their types, benefits, and how they can be leveraged by real estate professionals.

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. Modeled after mutual funds, REITs provide investors with a way to earn a share of the income produced through commercial real estate ownership without actually having to buy, manage, or finance any properties themselves.

Types of REITs

- Equity REIT

These are the most common type of REITs and involve ownership and operation of income-generating real estate. Equity REITs typically earn revenue through leasing space and collecting rents on the properties they own.

- Mortgage REIT (mREIT)

These REITs provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities. They earn income from the interest on these financial assets.

- Hybrid REIT

As the name suggests, hybrid REITs combine the investment strategies of both equity REITs and mortgage REITs, earning income from rent as well as interest on mortgages.

How REITs Work

REITs operate similarly to mutual funds by pooling capital from numerous investors. This pooled capital is then used to acquire and manage a portfolio of real estate assets. The income generated from these properties is distributed to shareholders in the form of dividends.

To qualify as a REIT, a company must adhere to certain regulations, including:

- Asset Requirements

At least 75% of the REIT’s total assets must be invested in real estate, cash, or U.S. Treasuries.

- Income Requirements

At least 75% of the REIT’s gross income must come from real estate-related sources such as rents or mortgage interest.

- Distribution Requirements

REITs must distribute at least 90% of their taxable income to shareholders in the form of dividends.

- Ownership Requirements

A REIT must be managed by a board of directors or trustees and have at least 100 shareholders. Additionally, no more than 50% of its shares can be held by five or fewer individuals.

Benefits of Investing in REITs

- Diversification

REITs allow investors to diversify their portfolios by gaining exposure to the real estate market without needing to buy property directly.

- Liquidity

Unlike direct real estate investments, REITs are traded on major stock exchanges, offering high liquidity and flexibility.

- Steady Income

REITs are known for their regular dividend payments, providing a steady income stream for investors.

- Professional Management

REITs are managed by experienced professionals who handle the day-to-day operations and management of the properties.

How REITs Benefit Real Estate Professionals

For students aspiring to become real estate professionals, understanding REITs is crucial for several reasons:

- Investment Opportunities

Knowledge of REITs equips future real estate agents with the ability to advise clients on diverse investment opportunities, including those who prefer the stock market over direct property ownership.

- Career Paths

REITs offer various career opportunities in property management, investment analysis, and corporate finance, broadening the potential career paths for real estate graduates.

- Market Insight

Studying REITs provides insights into the commercial real estate market, including trends in property values, rental rates, and the impact of economic conditions on real estate investments.

The Role of REITs in Real Estate Education

At RELNY, we ensure that our students gain a comprehensive understanding of REITs and their impact on the real estate market. Our curriculum covers the following aspects:

- History and Evolution

Tracing the origins of REITs and their regulatory framework.

- Market Analysis

Techniques for analyzing REIT performance and market trends.

- Investment Strategies

Exploring various REIT investment strategies and their potential returns.

- Case Studies

Real-world examples of successful REIT investments and the lessons they offer.

By integrating REIT education into our real estate courses, RELNY prepares students to navigate and succeed in the dynamic world of real estate investment.

Get Started Today on Your Real Estate License with RELNY

Real Estate Investment Trusts (REITs) are an integral part of the real estate investment landscape, offering numerous benefits and opportunities for investors and professionals alike. For real estate students, mastering the intricacies of REITs is essential for a well-rounded education and successful career in real estate. At RELNY, we are committed to providing our students with the knowledge and skills needed to excel in this exciting field. Whether you aim to invest, manage properties, or advise clients, understanding REITs will be a valuable asset in your professional toolkit.

Complete List of RELNY Real Estate Accreditations

RELNY is proud to be fully accredited by both the New York State Department of State (NYS DOS) and the Association of Real Estate License Law Officials (ARELLO®). This accreditation is more than just a formal recognition; it serves as a testament to the high standards of education and training we provide in the real estate sector.

RELNY's Unparalleled Learning Advantage

Kristen Bacorn's Online Real Estate Courses are Produced Exclusively for RELNY. As New York’s #1 Real Estate Instructor, Kristen’s engaging teaching style and comprehensive curriculum make RELNY the ideal choice for anyone looking to excel in real estate.

Unlock Success with RELNY: Purpose-Built Course Software

In the fast-paced world of real estate education, having the right tools can make all the difference between merely passing an exam and truly excelling in your career. RELNY’s purpose-built course software offers a suite of features designed to elevate the learning experience, making it easier, more engaging, and highly effective for students.

Meet RELNY's Kristen Bacorn, New York's #1 Real Estate Instructor

• NYS Department of State & ARELLO® Certified

• Masters, Harvard University

• Commercial & Residential Real Estate Broker

• Educator at RELNY, SUNY, CUNY, NAR, AIA

• Addressed the United Nations 2X

• Interviewed by Wall St. Journal & New York Times

RELNY FAQs

At RELNY, we understand that embarking on a career in real estate is a significant step, and choosing the right educational path is crucial. As the premier New York real estate school, we are dedicated to providing our students with the highest quality education and support. This FAQ page is designed to address some of the most common questions prospective and current students have about our courses and exam prep.

RELNY Job Placement Solutions: Your Bridge to Success

At RELNY, we are committed to more than just providing a top-tier real estate education—we're dedicated to ensuring our students thrive in their careers post-graduation. Our comprehensive Job Placement Solutions & Services are designed to support you every step of the way as you transition from being a student to a successful real estate professional.

Become a Licensed Real Estate Agent with RELNY Instructor Kristen Bacorn

Learn how to become a New York real estate agent from Kristen Bacorn - the #1 Real Estate Instructor in New York. Our accredited New York real estate licensing course can be completed in 1 week and can be taken online from the comfort of your home, or from your mobile phone.