Understanding Net Operating Income (NOI) for Real Estate

Essential Knowledge for Real Estate Licensing Students

-

Course Certified & Accredited by NYS DOS & ARELLO®

-

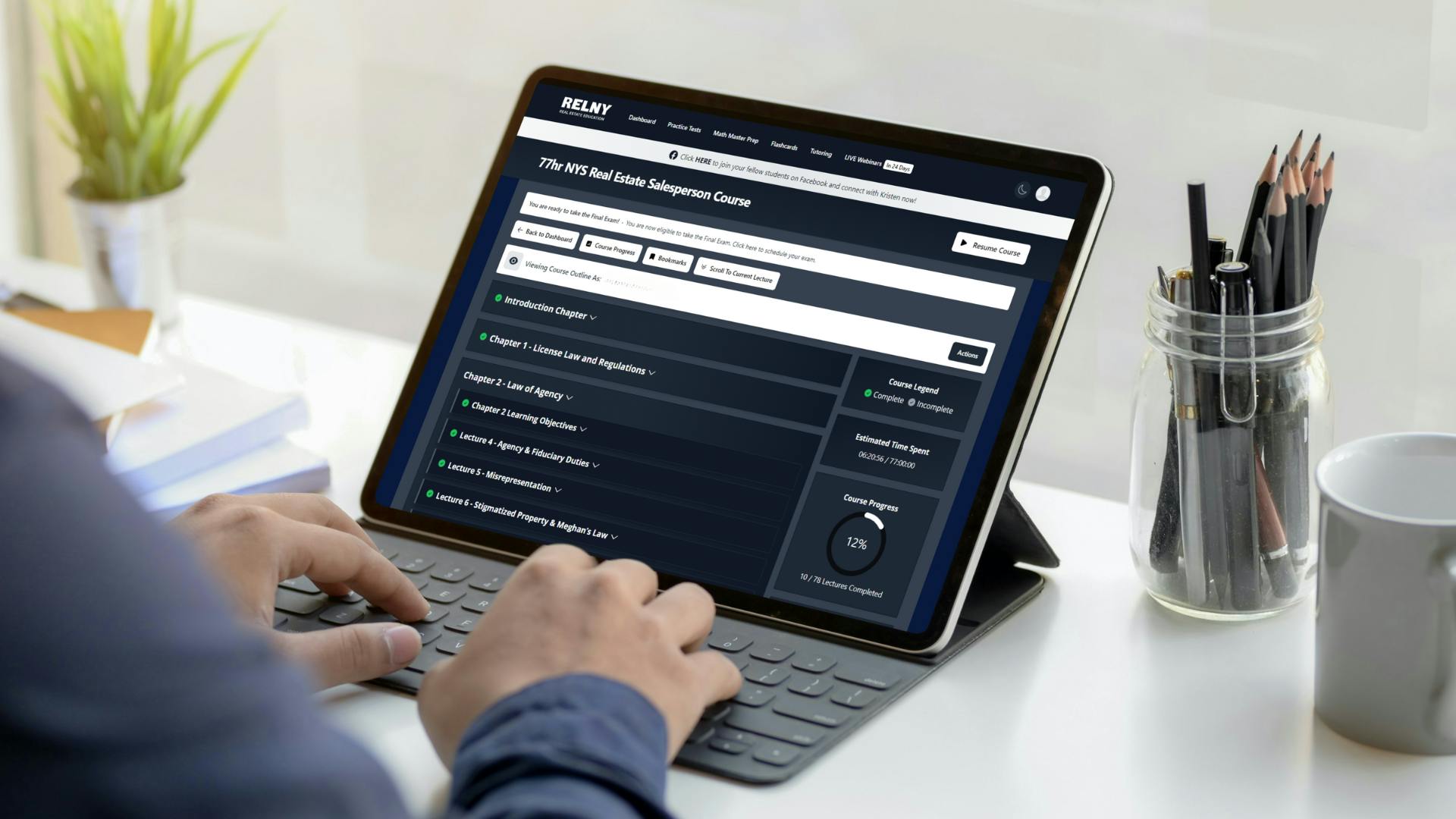

77 Hour NYS Real Estate Salesperson Licensing Course

-

Live Office Hours with Kristen

-

Take Final Exam at Home

-

Kristen's 1:1 Private Tutoring

-

Subtitles/Transcripts for all languages offered by NYS DOS

-

Call/Text (877) 997-3569

Understanding Net Operating Income (NOI) for Real Estate

When preparing for your real estate licensing exam, one of the crucial financial metrics you need to understand is Net Operating Income (NOI). As a future real estate professional, mastering the concept of NOI is essential for evaluating the profitability of income-producing properties. This comprehensive guide will help you grasp the essentials of NOI, ensuring you are well-prepared for your exam and your future career.

What is Net Operating Income (NOI)?

Net Operating Income (NOI) is a key financial metric used in real estate to evaluate the profitability of an income-producing property. It is calculated by subtracting all operating expenses from the total revenue generated by the property. NOI does not include mortgage payments, capital expenditures, or taxes, focusing solely on the property's ability to generate income from its operations.

The Formula for Calculating NOI

The formula for calculating NOI is straightforward:

NOI=Total Revenue−Operating Expenses

- Total Revenue

Total revenue, also known as gross operating income, includes all income generated from the property. This can encompass rental income, parking fees, vending machine profits, and other ancillary income sources.

- Operating Expenses

Operating expenses are the costs required to maintain and operate the property. These expenses include:

- Property management fees

- Maintenance and repairs

- Utilities

- Property insurance

- Property taxes

- Advertising and marketing costs

Example Calculation

Let’s go through an example to solidify your understanding:

Imagine you own an apartment building that generates $200,000 in annual rental income. Additionally, you earn $5,000 from parking fees and $2,000 from vending machines, bringing the total revenue to $207,000. Your operating expenses include $50,000 in property management fees, $20,000 in maintenance and repairs, $15,000 in utilities, $10,000 in insurance, and $5,000 in property taxes, totaling $100,000.

Using the NOI formula:

NOI=$207,000−$100,000=$107,000

In this scenario, the NOI is $107,000.

Importance of NOI in Real Estate

Understanding NOI is vital for several reasons:

- Property Valuation

NOI is used in capitalization rate (cap rate) calculations to estimate a property's value. The cap rate is determined by dividing the NOI by the property’s purchase price or current market value. A higher NOI indicates a more profitable property.

- Investment Decisions

Investors use NOI to compare the profitability of different properties. A property with a higher NOI is generally more attractive to investors.

- Financing

Lenders often consider NOI when determining loan eligibility and terms. A strong NOI can lead to better financing options.

- Performance Measurement

NOI provides a clear picture of a property's operational performance, excluding the effects of financing and capital improvements. This allows property owners to identify areas for operational improvements and cost management.

Key Points to Remember for Your Exam

- Differentiate Between Operating and Non-Operating Expenses

Remember that NOI only includes operating expenses, not mortgage payments, capital expenditures, or taxes.

- Understand the Impact of Income Sources and Expenses

Recognize how different income sources and operating expenses affect NOI. Be prepared to identify and calculate these elements in exam scenarios.

- Application of NOI in Real Estate Analysis

Be familiar with how NOI is used in property valuation, investment decision-making, and performance measurement.

Practice Question

To test your understanding, try this practice question:

You are evaluating a commercial property that generates $500,000 in annual rental income and $50,000 from additional services. The operating expenses include $100,000 in property management fees, $75,000 in maintenance, $30,000 in utilities, $20,000 in insurance, and $15,000 in property taxes. Calculate the NOI.

Answer:

Total Revenue = $500,000 + $50,000 = $550,000

Operating Expenses = $100,000 + $75,000 + $30,000 + $20,000 + $15,000 = $240,000

NOI = $550,000 - $240,000 = $310,000

Get Started on Your Real Estate Career at RELNY

Net Operating Income (NOI) is a fundamental concept in real estate finance that you need to master for your real estate licensing exam and your career. By understanding how to calculate and interpret NOI, you will be well-equipped to evaluate the profitability of income-producing properties and make informed investment decisions. Keep practicing your calculations and familiarize yourself with various scenarios to ensure you are ready for your exam.

At RELNY, we are committed to educating students and the success of your Real Estate career. By thoroughly understanding Net Operating Income (NOI), you’ll be well-equipped to excel on your exam and in your real estate career.

Complete List of RELNY Real Estate Accreditations

RELNY is proud to be fully accredited by both the New York State Department of State (NYS DOS) and the Association of Real Estate License Law Officials (ARELLO®). This accreditation is more than just a formal recognition; it serves as a testament to the high standards of education and training we provide in the real estate sector.

RELNY's Unparalleled Learning Advantage

Kristen Bacorn's Online Real Estate Courses are Produced Exclusively for RELNY. As New York’s #1 Real Estate Instructor, Kristen’s engaging teaching style and comprehensive curriculum make RELNY the ideal choice for anyone looking to excel in real estate.

Unlock Success with RELNY: Purpose-Built Course Software

In the fast-paced world of real estate education, having the right tools can make all the difference between merely passing an exam and truly excelling in your career. RELNY’s purpose-built course software offers a suite of features designed to elevate the learning experience, making it easier, more engaging, and highly effective for students.

Meet RELNY's Kristen Bacorn, New York's #1 Real Estate Instructor

• NYS Department of State & ARELLO® Certified

• Masters, Harvard University

• Commercial & Residential Real Estate Broker

• Educator at RELNY, SUNY, CUNY, NAR, AIA

• Addressed the United Nations 2X

• Interviewed by Wall St. Journal & New York Times

RELNY FAQs

At RELNY, we understand that embarking on a career in real estate is a significant step, and choosing the right educational path is crucial. As the premier New York real estate school, we are dedicated to providing our students with the highest quality education and support. This FAQ page is designed to address some of the most common questions prospective and current students have about our courses and exam prep.

RELNY Job Placement Solutions: Your Bridge to Success

At RELNY, we are committed to more than just providing a top-tier real estate education—we're dedicated to ensuring our students thrive in their careers post-graduation. Our comprehensive Job Placement Solutions & Services are designed to support you every step of the way as you transition from being a student to a successful real estate professional.

Become a Licensed Real Estate Agent with RELNY Instructor Kristen Bacorn

Learn how to become a New York real estate agent from Kristen Bacorn - the #1 Real Estate Instructor in New York. Our accredited New York real estate licensing course can be completed in 1 week and can be taken online from the comfort of your home, or from your mobile phone.